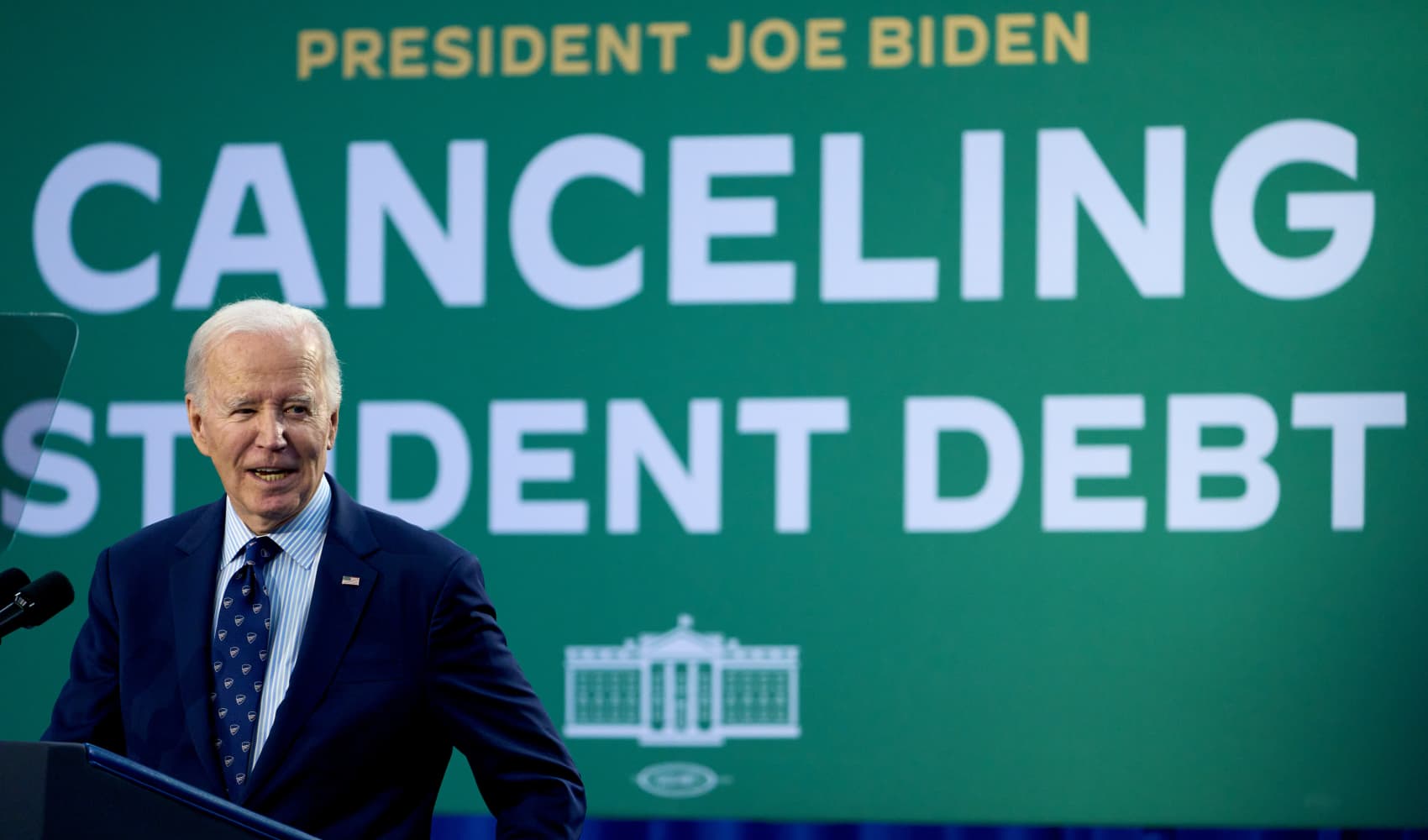

- The House Ways and Means Committee passed a tax package on Wednesday that would require withdrawals from retirement accounts worth more than $10 million.

- Peter Thiel, billionaire co-founder of PayPal, would likely need to withdraw all but $20 million of his Roth IRA, reportedly valued at $5 billion.

- Thiel, 53, would owe income tax on any investment earnings he withdraws due to current retirement distribution rules.

Billionaire Peter Thiel and others with huge retirement account balances are in lawmakers' crosshairs.

House Democrats unveiled a tax package on Monday that would force distributions from one's nest egg if the value of individual retirement accounts, 401(k) plans and other retirement stashes exceed $10 million.

Thiel, a PayPal co-founder, owns a Roth IRA that was worth $5 billion in 2019, according to a ProPublica report published in June, based on tax return data. The IRA was worth less than $2,000 two decades earlier.

Get top local stories in Connecticut delivered to you every morning. >Sign up for NBC Connecticut's News Headlines newsletter.

The House legislation would require Thiel to withdraw all but $20 million, nearly emptying the account, according to tax experts.

Roth IRAs are a type of after-tax account. Contributions are taxed upfront; investment earnings are tax-free, unless the owner withdraws funds before 59½ years old.

Money Report

Based on the bill's current language, Thiel, 53, would owe income tax on his investment growth — meaning he'd likely owe tax on nearly $5 billion, according to Ed Slott, an accountant and IRA expert based in Rockville Centre, New York.

(This example assumes the IRA is his only retirement account and that the account is still worth $5 billion.)

"The whole thing was written in response to Peter Thiel," Slott said of the House legislation. "Because he fits the profile: He's in his 50s and has $5 billion."

Thiel didn't immediately return a request for comment from CNBC.

His situation illustrates the tax impact new distribution rules may have on Americans with so-called mega IRAs.

More from Personal Finance:

Democratic plan would close tax break on exchange-traded funds

Terms of expanded child tax credit could still be up for negotiation

New York City is funding college plans for students

The House proposal is one of several changes to the tax code Democrats are aiming at the wealthy to raise money for up to $3.5 trillion of spending on education, paid leave, child care, health care and climate measures. The House Ways and Means Committee passed the tax package Wednesday, setting it up for a vote in the full chamber.

"IRAs were designed to provide retirement security to middle-class families, not allow the super wealthy to avoid paying taxes," according to Ron Wyden, D-Ore., chair of the Senate Finance Committee.

New distribution rules

Current law requires withdrawals from certain retirement accounts based on age. A 2019 law also created distribution rules for inherited IRAs and 401(k) plans.

The House legislation would add to those rules, asking wealthy savers of all ages to withdraw a large share of aggregate retirement balances annually. They'd potentially owe income tax on the funds.

The formula is complex, based on factors like account size and type of account (pretax or Roth). Here's the general premise: accountholders must withdraw 50% of accounts valued at more than $10 million. Larger accounts must also draw down 100% of Roth account size over $20 million.

Here are examples of the amounts at stake: An individual with a $50 million Roth account must withdraw $30 million next year; an individual with a $15 million pretax account would pull $2.5 million.

"This is a monumental change for anyone who has more than, say, $6 million or $7 million in their IRAs," according to Robert Keebler, an accountant and estate planner based in Green Bay, Wisconsin. "And it will immediately impact people with more than $10 million."

However, single taxpayers with less than $400,000 of income and married couples with less than $450,000 are exempt from the rules.

"If [Thiel] is really clever and can get his [adjusted gross income] below the threshold he will avoid this new rule altogether," Keebler said.

Not just Peter Thiel

The number of taxpayers with IRAs over $5 million tripled to roughly 28,600 from 2011 to 2019, according to a recent analysis by the Joint Committee on Taxation, the congressional tax scorekeeper.

They account for less than one-tenth of 1% of the roughly 70 million taxpayers with a traditional (pretax) or Roth IRA, according to IRS statistics.

However, the super-rich aren't necessarily the only ones with multimillion-dollar accounts — especially after the bull market for stocks coming out of the Great Recession.

"It's not just people like Peter Thiel," according to Beth Shapiro Kaufman, an estate planner at the law firm Caplin & Drysdale. "I see professionals who have amounts that could be into the two digits of millions, because the period of their working life was a phenomenal period in the stock market."

However, most people should be able to live comfortably on $10 million in retirement savings, she added.

Correction: An earlier version of this story misstated the age when you can take Roth IRA earnings tax-free. It is 59½.