- With federal student loan forgiveness up in the air and the rising cost of college now a top concern for families, parents are reprioritizing saving for higher education, recent studies show.

- Families are increasingly taking advantage of 529 college savings plans, which have even more benefits as of 2024.

- Yet only 30% of parents are on track to reach their savings goals, according to Fidelity.

With federal student loan forgiveness in jeopardy and the rising cost of college now a top concern for students and their families, more Americans are prioritizing saving for higher education.

In 2024, 74% of parents surveyed have started putting money away for college, according to Fidelity's College Savings Indicator — a spike from 58% in 2007, when the study was first conducted. Fidelity polled nearly 2,000 families with children high school age and younger between April and May.

"My husband and I just kept hearing from people with older kids about just how expensive college is," said Kathryn Bracho, 48, who lives in Green Bay, Wisconsin.

Get top local stories in Connecticut delivered to you every morning. Sign up for NBC Connecticut's News Headlines newsletter.

Bracho and her husband, Michael, started contributing to college savings accounts in 2017 so their sons — Declan, 15, and Taran, 12 — would have options after high school, she said.

More from Personal Finance:

FAFSA rollout was 'a stunning failure,' college aid expert says

The best private and public colleges for financial aid

More of the nation's top colleges roll out no-loan policies

"I don't know that we have as much as we had hoped, but just the fact that we've been steadily contributing gives me a certain degree of reassurance," she said. "They'll have to take out some loans but it hopefully won't be that crushing burden."

Money Report

To be sure, sky-high costs and concerns over ballooning student loan balances have weighed heavily on considerations about college for students and their parents.

"Families are beginning to row together in the same direction and realize the value of higher education and what they want to get out of higher education," said Chris McGee, chair of the College Savings Foundation, a nonprofit that provides public policy support for 529 plans.

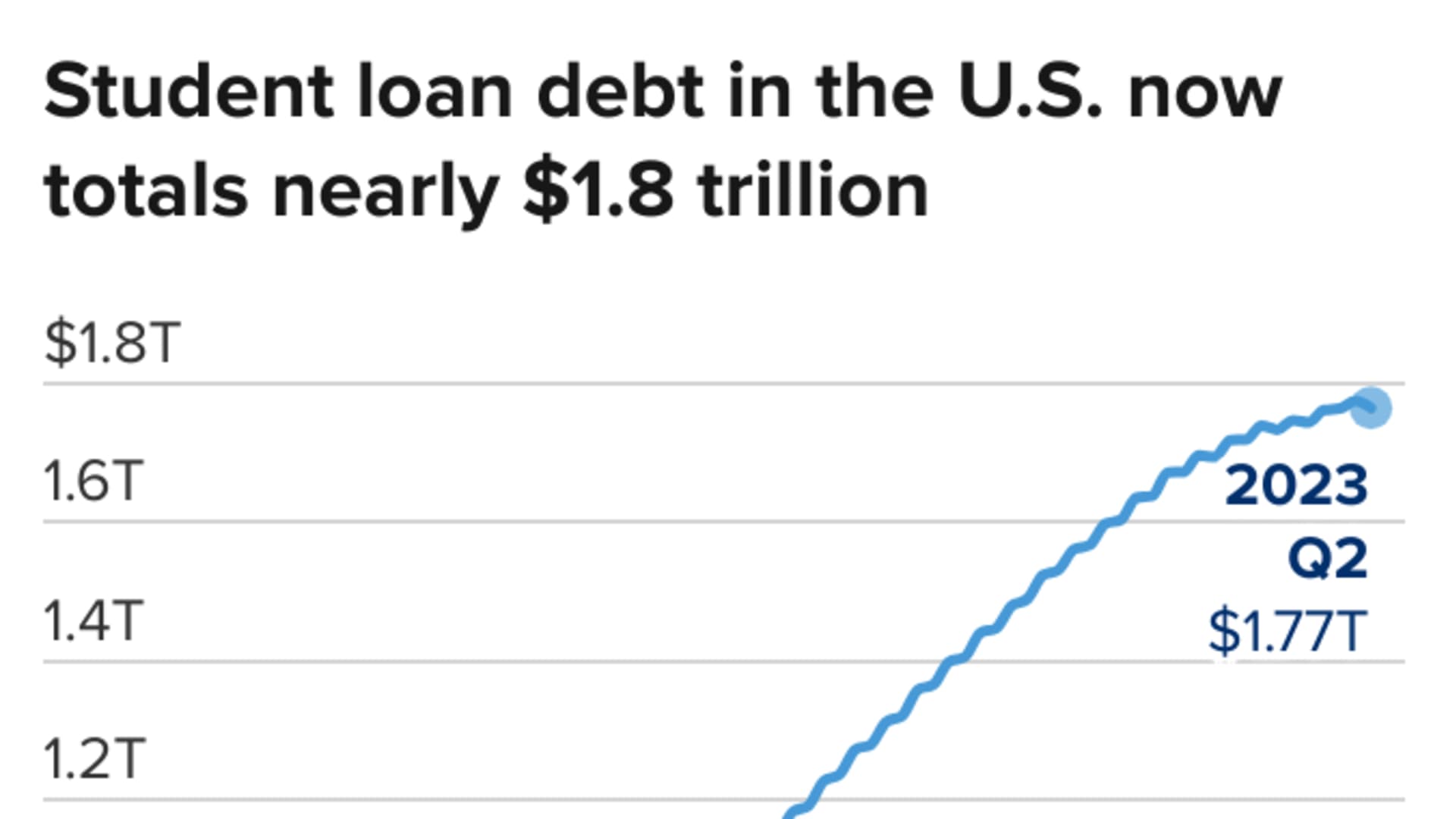

"Nobody wants to be part of the $1.7 trillion," McGee said, referencing the total amount of outstanding student loan debt.

How savings plays into covering college costs

David Ochs, a physician in Richmond, Virginia, owed $315,000 in education loans by the time he finished his residency. "It's been miserable," the 39-year-old said.

Now as the father of two sons, ages 1 and 5, Ochs said he started saving for their college educations soon after they were born because he didn't want them to experience the same hardship. "All of a sudden your life is all about trying to get out of a strangling debt."

Still, contributing to their 529 plans has necessitated sacrifices such as forgoing extra payments toward his student loans, he added. "I think it's a gesture of love."

Among the 94% of parents funding their children's higher education, almost half say that savings is their primary way of paying the tab, a new report by the College Savings Foundation found. The annual State of Higher Ed Savings survey polled more than 1,000 parents of children age 25 and younger in July.

For the first time in the College Savings Foundation survey's history, more than half of all parents said they are tapping a 529 college savings plan.

In 2024, total investments in 529s jumped to $450.5 billion in June, up nearly 10% from $412.5 billion the year before, according to data from the College Savings Plans Network, a network of state-administered college savings programs.

Financial experts and plan investors agree that 529 plans are a smart choice for many. And yet, in previous years, data shows that regular contributions to a 529 college savings plan often took a back seat to paying more pressing bills or daily expenses.

Even now, parents hope to use savings to pay for 67% of their child's education, but only 30% are on track to hit that goal, Fidelity found.

"A college education is still valuable, but it's the lack of planning that's a little bit alarming," said Tony Durkan, a vice president and head of 529 relationship management at Fidelity Investments.

The benefits of a 529 college savings plan

Among other recent changes, higher contribution limits and the flexibility to roll unused money into a Roth individual retirement account free of income tax or tax penalties have helped boost interest, McGee said.

The restrictions around 529s have also loosened to include continuing education classes, apprenticeship programs and even student loan payments.

"The legislative updates that have come through have certainly broken down barriers to entry to 529 plans," Fidelity's Durkan said.

Here's a closer look at some of the changes:

New Roth IRA rollover rules

Thanks to Secure 2.0, as of 2024, families can roll over unused 529 plan funds to the account beneficiary's Roth IRA without triggering income taxes or penalties. Among other qualifications, the 529 plan must have been open for at least 15 years.

That change follows the Secure Act of 2019, which let 529 users put some of the funds toward their student loan tab: up to $10,000 per year for each plan beneficiary, as well as another $10,000 for each of the beneficiary's siblings.

Previously, tax-advantaged withdrawals were limited to qualified education expenses, such as tuition, fees, books, and room and board. Now, 529s offer much more flexibility, even for those who never go to college, Chris Lynch, president of tuition financing at TIAA, told CNBC last year.

In that case, you could transfer the funds to another beneficiary or withdraw them and pay taxes and a penalty on the earnings. If your student earns a scholarship, you can typically withdraw up to the amount of the scholarship penalty-free.

Higher maximum contribution limits

This year, parents can gift up to $18,000, or up to $36,000 if you're married and file taxes jointly, per child without those contributions counting toward your lifetime gift tax exemption. That's up from $17,000 and $34,000 for married couples filing jointly in 2023.

High-net-worth families that want to help fund a family member's higher education could also consider "superfunding" 529 accounts, which allows front-loading five years' worth of tax-free gifts into a 529 plan.

In this case, you could contribute up to $90,000 this year, or $180,000 for a married couple. But then you wouldn't be able to give more money to that same recipient within a five-year period without it counting against your lifetime gift tax exemption.

A larger lump-sum contribution upfront may potentially generate more earnings compared with the same-size contribution spread out over a few years because it has a longer time horizon, according to Fidelity.

New grandparent 'loophole'

A new simplified Free Application for Federal Student Aid rolled out at the end of last year, with added benefits for grandparents who own 529 accounts for their grandchildren.

Under the old FAFSA rules, assets held in grandparent-owned 529 college savings plans were not reported on the FAFSA form, but distributions from those accounts counted as untaxed student income, which could reduce aid by up to half of that income.

As part of the FAFSA simplification, students no longer have to answer questions about contributions from a grandparent, effectively creating a "loophole" for grandparents to save for a grandchild's college without impacting their financial aid eligibility.

Tax deductions or credits for contributions

Even before recent changes, there were already many advantages to a 529 plan. In more than half of all U.S. states, you can get a tax deduction or credit for contributions. Earnings grow on a tax-advantaged basis, and when you withdraw the money, it is tax-free if the funds are used for qualified education expenses.

A few states also offer additional benefits, such as scholarships or matching grants, to their residents if they invest in their home state's 529 plan.