With thousands still waiting on unemployment checks, getting answers from the Department of Labor hasn’t been easy but NBC CT Investigates seeks answers on the state’s response times

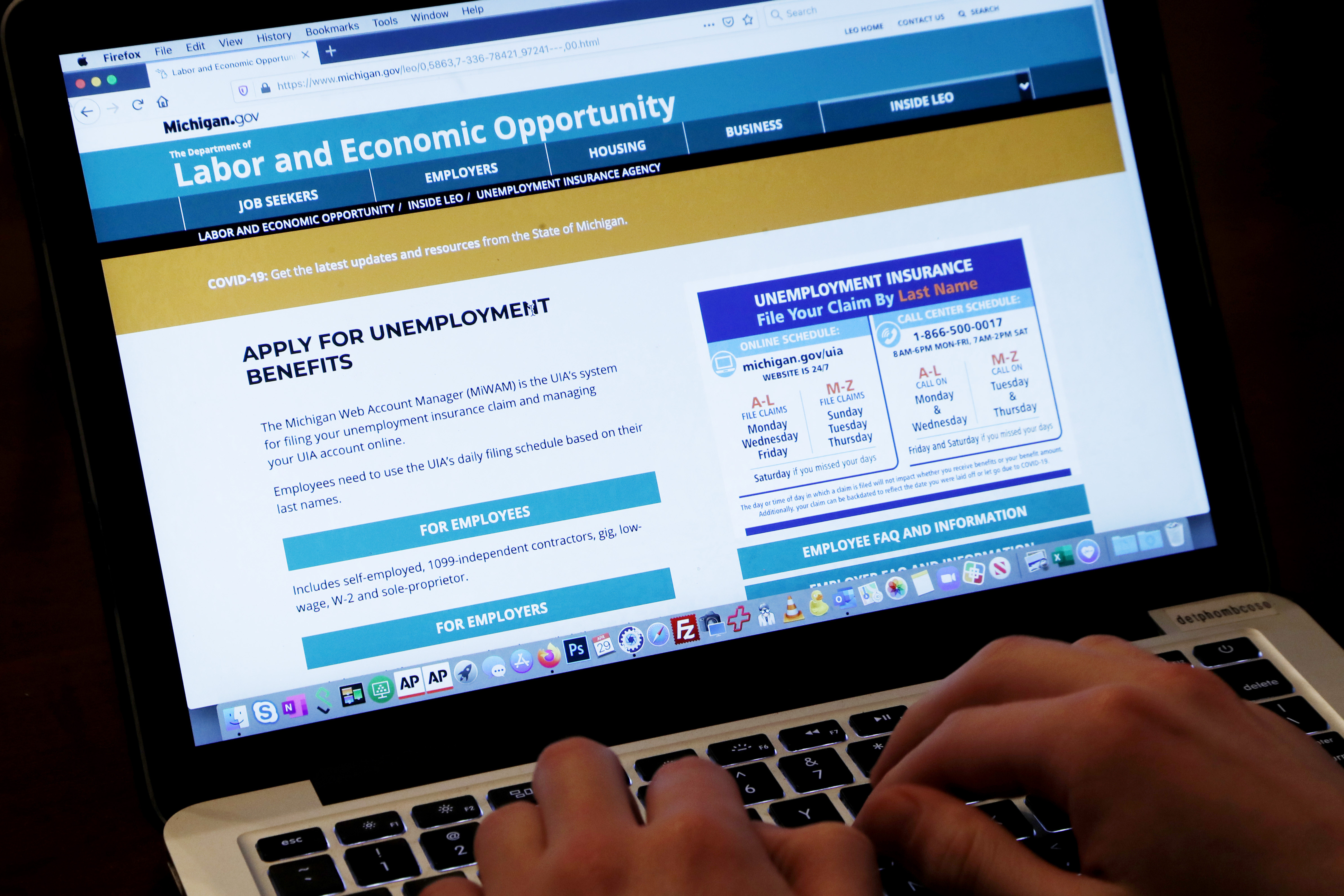

The Connecticut Department of Labor launched a new system Thursday for self-employed residents to be able to apply for federal unemployment benefits.

The benefits fall under the federal Pandemic Unemployment Assistance (PUA) program.

Under the federal guidelines, self-employed individuals must first apply through the Connecticut unemployment system and then will be able to apply on the state's PUA online system, according to the Department of Labor.

Four weeks ago, the department was "overwhelmed" by new claims given the state's existing manual systems and processes, said State Labor Commissioner Kurt Westby.

Currently, 90 percent of unemployment claims have been processed by the state's Department of Labor, Westby said.

The department said it has processed nearly two years of unemployment claims in a little over a month, according to Westby.

"We have made major progress with the first part of the CARES Act," Westby said.

Now, the department is turning its attention to the next part, including independent contractors and "gig" workers.

“Our agency is proud of the work it has accomplished in order to serve the self-employed – individuals who have not been eligible to apply for unemployment benefits in the past, but are now facing workplace situations never seen prior to the COVID-19 pandemic,” Westby said. “The new online ReEmployCT system meets mandated integrity requirements while providing a federally-required two-step application process.”

How to File For Unemployment Benefits

According to the department, self-employed filers looking for PUA benefits should first file a regular state unemployment claim (using the blue button on the site). Once you are determined to be eligible, you will be able to follow the next steps after clicking the red PUA application benefit button, which will not appear on the DOL site until the middle of the week of May 4.

Please note: That red PUA button is NOT on the site yet. The Department of Labor says to file a regular state unemployment claim first. Next week, if you are deemed eligible, you'll be able to finish the process, starting with the red PUA button. A step-by-step guide from the Department of Labor for self-employed individuals to file for PUA benefits can be found at the bottom of this article

Towards the end of the week of May 4, payments to the first group of PUA filers will begin to be sent out.

The department expects tens of thousands of self-employed to file for unemployment benefits through the PUA system, said deputy commissioner Daryle Dudzinski.

Dudzinski said it's possible there will be a backlog in PUA claims once they see how many claimants file.

For filers to be eligible for PUA benefits, they must have been impacted by the COVID-19 pandemic.

There have been a group of about 2,200 claimants who received one or two payments and then could not file further, Westby said. Those individuals have been identified and are being notified to be able to continue their claims. They will also receive retroactive benefits.

"We've been able to identify problems as they come up and we've been able to address them," said deputy commissioner Dante Bartolomeo.

Phone Number for Department of Labor Unemployment Claim Questions

The department said it has about 25 staffers answering phone calls from residents with questions about claims. The numbers for those help lines are 860-263-6975 or 203-455-2653.

If a filer does not have access to a smartphone or a computer, the staff at the call center will take your information and phone number and will call back the future applicants within five days to take their claim over the phone, Bartolomeo said.

Department of Labor Responds to Questions About Speed and Response

"The DOL is moving as fast as we conceivably can," Westby said.

Anytime someone who needs to reach the department and cannot, there is opportunity to do better, he said.

"We are going at lightning speed," Westby said. But he said that progress "is not good enough."

Considering the circumstances, "we've done a fantastic job," Westby said.

The department will be hiring 60 additional people over the next few weeks to help answer phone calls from residents, Westby said.The PUA program is set up to help claimants from February 2 through the end of the year, the department said.

The department said it is expecting "thousands of overpayments" during the pandemic, said Dudzinski.

Anyone overpaid should report those overpayments on the Department of Labor website, Dudzinski said, and everyone will have "due process" before being required to repay the money.

Step by Step Filing Instructions for Self-Employed Individuals

The below are instructions provided by the Department of Labor:

Self-employed individuals will follow this two-step application process:

Step 1). Beginning April 30:

- File a regular state claim application with the Connecticut Department of Labor at www.filectui.com, using the BLUEbutton to file.

NOTE: Self-employed individuals who already filed a claim application through this system SHOULD NOT file again. The agency has these original claims and a duplicate is not needed.

- After completing and submitting your application, look for an email from CTDOL:

“Thank you for submitting your online application for unemployment compensation benefits with the Connecticut Department of Labor. … Please look for a CONFIRMATION EMAIL notifying you that your claim has been processed. This email will include your NEXT STEPS information including instructions for when to start filing your weekly claims.

- Look for a second email from CTDOL:

“Your claim for benefits has been processed!If this is a new claim then we are sending information regarding your claim via US mail.”

- Look for your eligibility determination (Form UC-58 Monetary Determination) that must be sent through the US mail service.

· If the UC-58 Monetary Determination shows that you have a “zero” weekly benefit rate (which means you do not have wage earnings in the state system) you are not eligible for state benefits and are eligible to file in the ReEmployCT system for self-employed individuals.

· If the UC-58 Monetary Determination shows a weekly benefit rate, you have wage earnings in the state system and are entitled to collect state unemployment benefits.

Step 2) Once You Receive Your UC-58 in the Mail

- Go to CTDOL www.filectui.com for the link to PUA button.

- The PUA system will have a record of your state benefit ineligibility status.

- Complete the PUA application –

-Applicants will need 2019 IRS forms, 1099, 2019 W-2s, and Schedule C. Applicants will be asked to provide earnings for 2019, broken down by quarters. Those without tax records for 2019 can self-attest their earnings, but will be subject to audit.

- Applicants will be asked the date when COVID-19 impacted their employment. Federal guidelines allow this to go back to Feb. 2, 2020. If an unemployed status goes back to retroactive weeks, the system asks the claimant for weekly earnings through the current week filing.

- Once the PUA application is completed, if applicants did not select a payment method when filing under the state unemployment system, they will select their method of payment (direct deposit or debit card – the agency recommends direct deposit for much faster payment). Payment selection is made by returning to www.filectui.com and selecting the “method of payment” green button.

Get top local stories in Connecticut delivered to you every morning. Sign up for NBC Connecticut's News Headlines newsletter.

Frequently Asked Questions on PUA Benefits for Self-Employed Filers

- What is the Pandemic Unemployment Assistance program?

Pandemic Unemployment Assistance (PUA) is a program that temporarily

expands unemployment insurance (UI) eligibility to self-employed workers,

1099 employees, "gig" workers, workers in jobs not covered by regular

unemployment benefits, and independent contractors impacted by the

coronavirus pandemic in 2020.

In general, PUA provides up to 39 weeks of benefits to qualifying individuals

who are otherwise able to work and available for work within the meaning

of applicable state unemployment compensation law, except that they are

unemployed, partially unemployed, or unable or unavailable to work due to

one of the COVID-19 related reasons. - Who does PUA cover?

PUA provides benefits to covered individuals, who are those individuals not

eligible for regular unemployment compensation or extended benefits

under state or Federal law or pandemic emergency unemployment

compensation (PEUC), including those who have exhausted all rights to

such benefits. Covered individuals also include self-employed, those

seeking part-time employment, individuals lacking sufficient work history,

and those who otherwise do not qualify for regular unemployment

compensation or extended benefits under state or Federal law or PEUC. - How many weeks of PUA can be collected?

Individuals eligible to collect PUA who were not eligible for regular

unemployment benefits (such as the self-employed) can collect up to 39

weeks of PUA. - Can I work part-time while collecting PUA?

Yes, you can work part-time and file for partial benefits under PUA by

reporting your earnings when you file your weekly certifications. Two--

thirds of your report earnings will be deducted from your PUA benefit rate

for weeks you report your part-time work and wages. - If I collect partial PUA benefits, can I extend the duration of collecting

past 39 weeks?

No, unlike regular unemployment benefits where you can file more than 26

weeks if you file partials, PUA is payable for 39 weeks of filing, regardless if

the weeks are partial or total benefit weeks. - What is the duration of the PUA program?

Based on the current legislation, PUA will be effective for weeks of

unemployment beginning on or after February 2, 2020 and ending

December 26, 2020. - Are PUA benefits Taxable?

Yes, PUA benefits are taxable against both the federal income tax (IRS) and

state income tax. - What are the minimum and maximum PUA weekly benefit amounts?

The minimum PUA weekly amount is $198. Currently the maximum PUA

weekly amount is $649. The maximum weekly benefit amount is adjusted

annually, in October. - Will the Federal Pandemic Unemployment Compensation (FPUC) payment of

$600.00 be added to PUA payments?

Yes, PUA payments between April 4, 2020 and July 25, 2020 will include the

FPUC payment of $600.00 - Does the PUA program use the same system to submit a PUA application

as the regular unemployment benefits program?

No. The Pandemic Unemployment Assistance program is managed in a

system separate from the regular unemployment system, called

ReEmployCT. - Where would I add or modify payment option (Direct Deposit, Debit Card)

while collecting PUA? In the PUA system?

No, use the CT Tax and Benefits (CTABS) system to add or modify payment

information. CTABS is accessed at www.filectui.com (This is the GREEN

button on the www.filectui.com site.). - If I have an unemployment overpayment, will it be offset against PUA?

Yes, federal law stipulates that unemployment overpayments be recouped

100% against PUA.

Note - If you have an outstanding unemployment overpayment, your

weekly certifications will be delayed pending until the programming isin

place to properly offset the overpayment. - Will my child support be deducted from PUA?

Yes, if CTDOL has an active child support order against your claim, child

support will be deducted weekly from each payable week in accordance to

state statute while receiving PUA benefits.